Want to know how to pay off credit cards fast? These 5 genius tips are not to be missed.

If you have credit card debt, you are not alone. In fact, many studies show that nearly half of credit card users had a balance at some point. Credit card debt is a very common problem for people to deal with, and it can be really hard to figure out how to pay off credit cards, especially with a low income. The truth is, it doesn't matter HOW or WHY you found yourself in credit card debt, there is a way out for you!

In this post, I will list the very best strategies for how to pay off credit cards fast. When I was $150,000 in debt, these are the exact strategies I used to pay off my debt FAST- in less than 16 months! Trust me, if there's anything I know about, it's how to pay off debt quickly.

This post is all about how to pay off credit cards.

HOW TO PAY OFF CREDIT CARDS

More posts you'll like...

Step 1- Assess the Damage

#1 - How to Pay Off Credit Cards

Let the fun begin... The first step is to find out exactly how much credit card debt you have.

This might be the part you've been putting off for a long time. But, fear of the unknown is ALWAYS worse than the reality. Once you know how "bad" the situation is, you'll feel better knowing there's a way to fix it. Lean into the fear and get this done. I felt a bizarre sense of relief and calm when I finally totaled up my debt, even though the number was higher than I thought. Somehow hiding from the truth hadn't brought me any peace, but taking action did.

Maybe you have more credit cards than you can count! This might be a task for some who have a complicated credit card debt situation. You can always pull your credit history for free if you want to find out exactly how much debt you have.

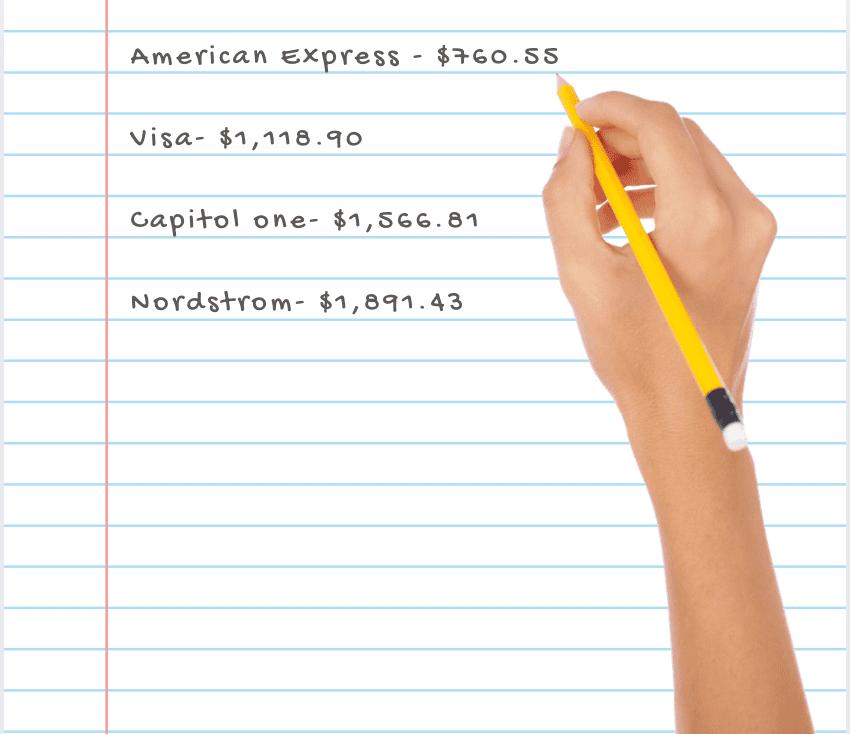

Sit down with a pen and paper, a chisel and stone, or a blank Excel document, and take the time to list all of your credit card debts from smallest to largest amount. INTEREST RATE IS IRRELEVANT (WHAT??). Yes, I don't care what the interest rate is on any of your cards. I don't care if one is 0% and one is 22%. It doesn't matter- just list them from smallest to largest amount. This is because we are going to use the fastest way to pay off debt, the debt snowball method. Add up and write down your total debt amount. Take a good look- you're NEVER going to see that number again!

Step 2- Stop the Bleeding

#2 - How to Pay Off Credit Cards

Before we move on to how to pay off credit cards, there's another important step we need to take. We need to stop the bleeding! This means we need to stop going into debt. This is a crucial step, or you will never be successful at paying off credit cards. You cannot get out of debt by going into debt. If you're serious about becoming debt free, we have to stop repeating the same decisions that got us into debt in the first place. So make a commitment to yourself- never. again.

As Dave Ramsey says, it's time for plastic surgery. Chop those credit cards up! It's time to whip out our old trusty friend- the debit card.

Step 3- It's Time to Make a Plan (and stick to it!)

#3 - How to Pay Off Credit Cards

The fastest way to pay off credit cards is to use the tried-and-tested snowball method. This means we are going to attack the smallest debt with everything we have! We will be laser focused on that one littlest debt! In the meantime, you will continue making the minimum payments on all other credit cards. Have a low income? Click here for extra tips for paying off debt FAST.

Once the smallest debt is gone, it's time to move on to the next largest debt. This process continues until you are debt free! The snowball method works because it allows you to feel great from getting those quick wins.

It might be hard to ignore the interest rates, but trust me, this process works. It is the same process I used, and I was able to pay off $150,000 in debt in only 16 months!

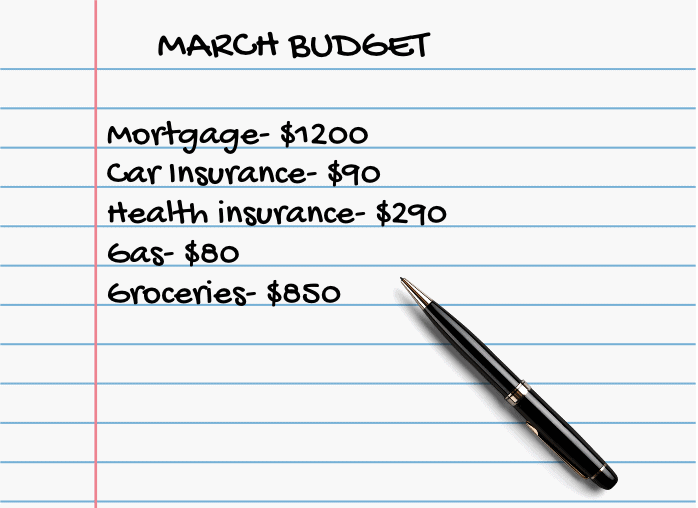

If you do not have a detailed, written budget, it's time to do that too. I'm assuming you don't or you wouldn't be in debt... I use the EveryDollar app and an excel sheet to track my budget. Etsy has beautiful and cheap budget templates, or you can make your own in excel! Simply list all your expenses. I divide mine by fixed and variable expenses. You won't be perfect at first, but after a few months you should have your budget down pat.

Step 4- It's a ~Family Affair~

#4 - How to Pay Off Credit Cards

Did you know Mary J was actually singing about paying off debt?

If you are married and/or have children/teens, it's important to get the whole family on board with the plan to become debt free. This process is going to involve some major changes, and everyone needs to be prepared. You cannot do this by yourself, your spouse MUST be on the same page as you. Money is the #1 cause of divorce, we all know this sad fact. And it makes sense! What topic could possibly be more difficult to work through? It's really hard, but these hard conversations have to happen.

Instead of looking at money as a "problem" in your marriage, look at it for what is really is- an opportunity for your marriage to be stronger than ever. When you're on the same page about money, it allows you and your spouse to function as a true team. Don't be afraid to seek professional help if needed.

Honey! I shrunk the kids' budget!

Don't forget the kiddos! Children of all ages can participate in this journey. I don't think it's ever too early to learn about responsible financial decisions. Talk to your kids about what changes are going to happen- maybe the meals will look a little different. Children respond better to change if they are given an advanced warning and time to adjust. Don't be afraid to explain the reason either- Mom and dad have raised the standards for their life and are going to become debt free! This is a journey to be proud of.

If you have teenagers, they can participate to an even greater degree. Perhaps your teen(s) can get a job and pitch in? You'd be surprised at how rewarding it can be for children to feel like they are truly contributing to the household. Don't forget it's temporary! And on the other side, massive reward and MORE money to spend on the things you love. Read more about how to talk to teenagers about money here.

This is an opportunity for your kids to learn from your mistakes and avoid making the same financial mistakes in their own lives later on, so don't hide it from them.

If you're unmarried and don't have kids, enlist friends, family and loved ones to offer you support and encouragement along this journey! I wasn't married yet when I paid off my debt, but having people in my corner to cheer me on was invaluable.

Step 5- Stay Motivated

#5 - How to Pay Off Credit Cards

It's a marathon, not a sprint. Depending on how much debt you have, a debt free journey can be grueling and a true test of endurance. It's really important to stay motivated throughout your journey. It might seem silly, but the little things I did to make paying off my debt "fun" were actually really helpful to keep me going!

One thing I did to stay motivated was making paper chains of debt that I hung up on my wall. I assigned a dollar amount to each paper chain, and as I paid off my debt, I cut the chains off. I color-coordinated the chains for each $10,000 of debt I had, which also helped. It was so fun for me to move from one color to the next.

Another thing I did was have a coloring chart/tracker hung on my fridge! I made my own on Canva that was Game of Thrones themed (which I called Game of Loans). Etsy has tons of really fun coloring sheets!

Follow my instagram for daily debt free inspo and quotes!

Other options for visual debt payoff trackers include having a jar filled with marbles that each represent a certain dollar amount, and as you pay off your debt you take marbles out.

I also created a debt free vision board using Canva that I kept on my desktop. This was one of the most helpful things I did, and I made sure to look at it at least once a week or any time I was feeling unmotivated. I had photos of beach vacations and yummy cocktails!

Envisioning and reflecting on how great your life is going to be after you pay off your debt is one of the best things you can do to increase your chances of success. I would think about all the things I was going to be able to spend money on once I didn't have so much of my income going towards debt! That's the great thing about paying off debt, it's temporary pain for massive reward on the other side.