Want to know how to pay off student loans fast? This post is about the best way to pay off student loans.

Consumer debt and student loans are very common. If you're like me, you've found yourself with too much debt and not enough money. I paid off my graduate student loans fast and these are the tips I swear by.

You will learn all about my student loan payoff plan and what worked to pay off student debt quickly. After learning my essential tips and tricks to pay off debt fast, you will never look at debt the same.

This post is all about the essential strategies for how to pay off student loans fast.

How To Pay Off Student Debt

How I Found Myself in Debt

I graduated from Physician Assistant school with over $150,000 in student loan debt. Going into PA school, I didn’t think much of taking out 6 figures in consumer debt. My parents had generously paid for my undergraduate education, and I had never had any debt before. Nice try mom and dad!- but I wasn’t about to miss out on the all-American experience of crushing student loan debt. I felt like because I had worked so hard to get accepted into PA school, I deserved to go to the best school that I could, regardless of cost.

Throughout my time in school, I hardly thought of my debt, and to be honest, it felt like monopoly money. I didn’t even calculate my total debt until 1 month after graduating. I remember that day vividly, staring into the white abyss of an excel sheet with tears in my eyes. I had much more debt than I anticipated. I thought I owed about 130k, but I owed over $150,000. In that moment I felt confused, anxious, overwhelmed, but mostly, I felt fear. What if something happened to me, and I couldn’t pay this off, like illness or an injury? I also felt a deep pang of regret for what I had gotten myself into- what was I thinking?

In anticipation of starting a job as a PA and making a 6-figure salary for the first time, I purchased about a dozen personal finance books based on the top recommendations online. I wanted to educate myself and make sure I was doing right by my new income. I grabbed one at random to start, and it happened to be Dave Ramsey’s Total Money Makeover. His wealth-building strategy recommends paying off all consumer debt as aggressively as possible, before investing in retirement. I was surprised to read this, as I had previously assumed I’d just make the monthly payments on the standard 10-year repayment plan. However, I found that this strategy really spoke to me, and it felt obvious to me as the most logical path to building wealth. When you encounter true wisdom, you feel it. Unfortunately for me, this meant tackling over 150k in student loans before I could have any fun. I had been planning to relax and enjoy life after graduate school. I had envisioned buying new clothes, renting a nicer apartment, and going on vacations. Hadn't I earned that by getting through school? Dave didn’t care. With a few turns of page, my dreams of post-graduate leisure were squashed as Dave spoke to me through his book, “you’re broke, lady!” This was an adjustment for me mentally, but I was more than on board. I couldn’t deny the truth, I was broke. I finished the book feeling inspired but a little doubtful, could I really do this? But already the idea of being debt free was so appealing to me, and I was eager to get started.

Step 1: Get Clear

The first thing I did was total my entire debt in an excel sheet from smallest to largest. An easy way to do this is to review your credit report for free. I then calculated how many months it would take for me to become debt free with a strict budget and working multiple extra jobs. I realized, with surprise, that I could pay off my debt in less than two years with some hard work and discipline. This realization was critical, because I was willing to cut my lifestyle drastically if it was only 2 years. I thought, what could I give up for less than two years? A lot of discretionary spending came to mind that I wasn’t willing to consider cutting over a 10-year repayment plan. I could stop dying my hair for two years, wearing contacts, and getting my nails done. Surely, I had enough clothing to last me two years without shopping for more. And the best part, the more I cut my spending, the shorter the time I had to go without it.

Step 2: Get Motivated

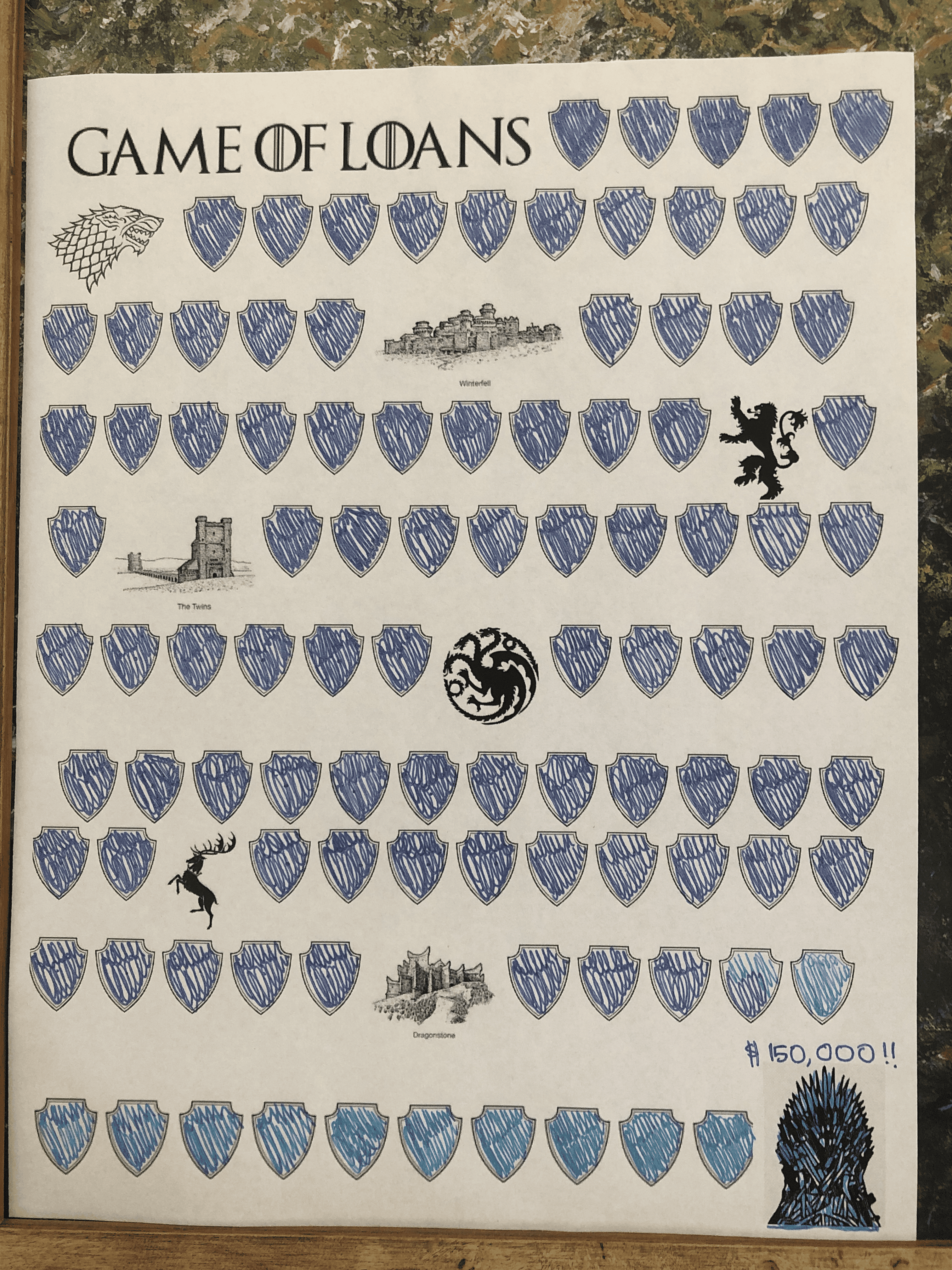

I knew that this journey was going to be much more of a mental struggle than a math struggle, so I looked into ways to keep myself motivated. One idea I found online was to make paper chains of debt. I got out my construction paper and scissors, and 1 season of Selling Sunset later, I was done! I assigned a dollar value to each paper chain, with the plan to cut them off as I made payments on my loans. I switched colors for every $10,000 to help break up my debt visually. I hung them in my bedroom so that they could serve as a an unavoidable and daily reminder of my current financial ruin. How many months would this Matisse-inspired monster be the last thing I saw before I went to bed and the first thing I saw when I woke up? I also created a Game of Thrones inspired coloring sheet to color in as I paid of my loans. I titled it “Game of Loans,” which my mom enjoyed. Most importantly, I used the debt snowball method, which allowed me to celebrate quick victories early by starting with the smallest debt first. Throughout my debt-free journey, these little victories of removing chains and coloring in my sheet made a world of difference. It felt so satisfying and added some fun to the process.

Step 3: Cut Your Spending

As I mentioned above, cutting my lifestyle was crucial. I adopted an extremely disciplined mindset where if it was not needed to sustain my life, I did not buy it. Goodbye DoorDash addiction, hello austerity! This was easier to do when I knew that every dollar I was spending would have to be earned back through hours at work. It was an easy trade-off when I assigned a “time-at-work” amount to each dollar. $200 for a new dress? That’s 5 additional hours at work this month- not worth it. This concept is described in a life-changing book I love, Your Money or Your Life. Ask yourself what you could live without for just a few months, knowing that you can have it as soon as you’re debt free. There was pretty much nothing I wasn’t willing to say goodbye too. In addition, switching to cheaper insurances is a one time step that can save you thousands. The deeper you lean in, the deeper you’re willing to sacrifice, the faster you are done- forever.

Step 4: Increase Your Income

Even more important than cutting my spending was drastically increasing my income. As a new graduate PA, my starting salary was $110,000 at my 40-hour a week day job. After giving generously to the government via taxes, that left me with $6,500 per month. My minimum payment on my student loans was close to $2,000 per month (OUCH). After rent, insurance, and food, this didn’t leave me with nearly enough margin to pay off my loans in 2 years. I buckled down and got to work applying to every job I could. I was willing to work anywhere within driving distance, in any setting, with any hours. Evenings, weekends, overnights, and holidays were all fair game. As a new graduate with no experience, I was at a major disadvantage in the job market as training me properly would be an investment for the employer. I spent at least 10 hours per week applying to second jobs. As I waited to get additional work as a PA, I got lower paying jobs where I could. I hung flyers in my apartment complex advertising cleaning and pet-sitting services, and although the building management promptly ripped them down, I got a job! I was able to pet-sit at the same time I took virtual appointments, getting paid for 2 jobs at once. I also looked into the easiest and highest paying work from home jobs, and was able to make hundreds of dollars online by taking simple surveys. I nannied and babysat as much as I could, and I picked up weekend and evening hours at my current PA job.

A few months went by, but eventually my hard work paid off. I was hired at 2 additional jobs as a PA, one in a hospital and one taking virtual appointments. One job of those jobs had a rule that they did not hire PAs with less than 6 months of experience, but I was able to talk the recruiter into giving me a second interview anyways- it worked, and I got hired. I was determined and was not going to take no for an answer. Each job would add 20+ hours onto my current workload, totaling 80-100 hours per week, effectively doubling my income. Shortly after, I got a 4th part-time job working at my alma mater through begging my former professors to hire me networking.

I started all 3 jobs within 6 weeks of each other, and it was brutal. I was a new PA, and I had a lot to learn. Most days I felt completely incompetent, but I pushed through the fear that one of my many initial mistakes would get me sued. I saw my end goal clearly, and on tough days, I reminded myself that this struggle was temporary. I looked at this like a self-imposed residency. I would get the hang of it soon, and soon after, I’d be debt free. I’d never have to work a second, third, or fourth job again if I didn’t want to, for the rest of my life!

Step 5: Have a Plan

I could not have paid off my debt without a detailed budget and mapped out plan. I used the Every Dollar budgeting app and loved it. It kept me on track, and it kept me motivated. I tracked every purchase and every dollar earned. I was constantly looking for ways to further cut my spending. I went over my expenses using the Every Dollar app every week, and I also used an excel sheet. It was surprisingly fun and motivating to see how much I could pay to my loans at the end of the month if I kept on track. I took it one day at a time and set monthly goals for myself. I concentrated on getting through the next $10,000 that I owed, and this was easier with my multi-colored chains of debt. I had a visual for how far until that goal was reached.

Step 6: Raise Your Standards

Consumer debt is a common problem today, with most people feeling like there is no way not to have it- a suffocating car payment? That’s just life. But there is a better life waiting for you on the other side of debt. Paying off my student loans was the greatest gift I’ve ever given myself, and I will reap the rewards for the rest of my life. The time went by so fast. The first real step is to raise your standards. Is consumer debt really a part of your ideal life? I highly doubt it. If the answer is no, know that you can pay it off and say goodbye to debt forever. I’ll end with a favorite quote I reflected on often throughout my debt free journey:

“What are you willing to give up to go up?”