What is debt-to-Income ratio? Learn how to calculate your debt-to-income ratio in this post.

What is debt-to-income ratio? Millions wonder, few ever know. Allow me to lift the veil. Perhaps you are applying for a credit card or a mortgage, or maybe you just want to understand your current overall financial health. Until you pay off all your debt, finding out your debt-to-income ratio is a helpful tool.

In this article, I will explain exactly what debt-to-income ratio is, why it's important, and how you can calculate your debt-to-income ratio. Your debt-to-income ratio is important to know if you are planning to apply for any kind of loan, including a mortgage! The lender (i.e. the bank) will look closely at your financial situation, and your debt-to-income ratio is a key metric they will use.

This post is all about what is debt-to-income ratio.

What is Debt-to-Income Ratio?

More posts you'll love...

What is Debt-to-Income Ratio?

Just like your credit score, your debt-to-income ratio (or DTI for short) is a calculation that can be used to assess your overall financial health. Most commonly, lenders will use DTI to assess your financial status and see if you are a good candidate for a loan. However, it's also important for you to know your debt-to-income ratio so that you understand your current financial situation (and more importantly, your current financial risk!). DTI can be used to assess risk by determining if you have "too much debt" compared to your overall income. The more debt you have, the more at risk you are. This is exactly why lenders calculate this number, they don't like lending money out if they won't get it back! DTI can also affect what interest rate you will be offered. If you are a higher risk candidate, the higher the interest. If you do not have ANY debt, then you cannot really calculate a DTI (it would be 0%). If you're like most people though, you do have some debt, so keep reading!

Your debt-to-income ratio is exactly that, a ratio or a fraction! It compares your total debt to your total gross income (meaning before taxes are taken out). So what debts are included in this calculation?

Here is a list of which debts would be included in debt-to-income ratio:

- Mortgage

- Auto loan

- Personal loan

- Student loans

- Credit card debt

- Child support

- Alimony

Now, what income would be included in this calculation of debt-to-income ratio? The answer is all your income BEFORE taxes are deducted AKA your gross income.

Here is a list of income sources that should be included when calculating your debt-to-income ratio:

- Salary and any other earned income

- Pension

- Social Security

- Alimony

- Child Support

How to Calculate Debt-to-Income Ratio

Now that we've answered the question- What is debt-to-Income ratio? Let's find out how exactly it's calculated. Debt-to-income ratio is your total debt divided by your total gross income. This can be calculated either on a monthly basis OR an annual one. Debt-to-income ratio is expressed as a percentage. It is quite literally the percent of your income that goes towards debt compared to what you earn in total.

How to calculate debt-to-income ratio? Follow the simple steps below. (Tip: Using Excel or Google Sheets will make this a lot easier!)

1. Add up all your debts (see the example list of debts above). I recommend using monthly values instead of annual.

2. Add up all your monthly income (don't forget this is BEFORE taxes!). See the list of example income above.

3. Divide the total monthly debt amount by the total gross monthly income amount.

4. Multiply by 100.

5. Add a % symbol.

6. And there's your DTI! Pat yourself on the back! Will Hunting would be impressed at your mathematical prowess.

How to Calculate Debt-to-Income Ratio With Example!

Now let's do the calculation with an example so that you can see DTI come to life in real time. Exciting I know. For this example, we will be calculating the DTI of a Mr. Walter White. He is a local high school teacher and wants to know his DTI because he is looking to finance a new Chrysler. He recently was diagnosed with lung cancer, so let's help him get a sweet ride.

First, what are Walter's monthly debts? They are listed below:

- $1,200/month to Mortgage

- $250/month to Student Loans (for a PHD with an emphasis on X-Ray Crystallography)

- $300/month in medical bills (for lung cancer treatment)

TOTAL: $1,750/month in debt payments

Next, let's add up Walt's gross monthly income. He is married, so his wife's income would be included.

- $3,500/month in gross income from his main job as a high school teacher

- $1,000/month working part-time at a local carwash

- $1,000/month from his wife's part-time job at Beneke Fabricators Inc.

TOTAL: $5,500/month in gross household income

Now, to calculate the debt-to-income ratio we simply divide the first number (total monthly debts) by the second calculated number (total monthly gross income).

$1,750/$5,500= 0.318

Then, we multiple this number by 100 and add a % sign.

0.318 X 100 = 31.8%

Drumroll... Mr. White's DTI is 31.8%.

So... what does this mean exactly? See below for how to interpret DTI.

You can also use an online debt-to-income ratio calculator here!

What Is a Good Debt-to-Income Ratio?

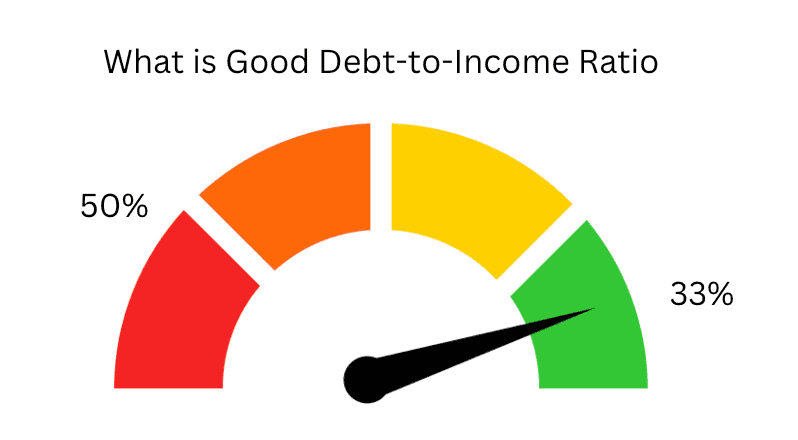

Again, debt-to-income ratio is most often used by lenders to assess your eligibility for a loan (like an auto loan, a mortgage, etc.). So, what exactly are they looking for? What is a good debt-to-income ratio? What is a bad debt-to-income ratio. The answer is- it depends on the lender! Some are more risk averse than others. But there are general parameters you can use to estimate your financial health based on your debt-to-income ratio.

For a home loan or mortgage, the generally accepted DTI limit is 36% for a conventional home loan. Again, there might be some variation between lenders, but this is the expected standard. Keep in mind, this INCLUDES your new mortgage factored in to your DTI. So if your debt-to-income ratio is already at or above 36%, it is unlikely you will be able to qualify conventional mortgage. By comparison, credit card lenders may tolerate up to a 45% debt-to-income ratio.

Per general consensus, a DTI of 33% or less is considered "acceptable" or "manageable", whereas a DTI of 50% or greater is considered "too high".

How to Lower Debt-to-Income Ratio

Unsurprisingly, I think we should all strive for a beautiful debt-to-income ratio of 0% (meaning no debt!). Debt is an albatross around your neck weighing you down and eating up your precious income. Lenders want to encourage you to obtain and stay in debt (because they make money off of you!). A real sign of wealth is getting to a place where debt-to-income ratio is irrelevant for you, because you pay cash. If you're in debt and looking to turn things around, learn how I paid off over $150,000 in student loans in under 2 years (and how you can too).

However, I am a realist and understand that most of us will need to get a mortgage at some point, especially early on in our lives. For this reason, learning to calculate your debt-to-income ratio and learning what is debt-to-income ratio is important.

If you calculated your debt-to-income ratio and saw that it was higher than "manageable", that might explain why you feel like you have too much month at the end of your money. Start by making a plan to pay off debt and increase your income today! The steps I recommend to lower your debt-to-income ratio are the same ones I took to pay off all my consumer debt. After you calculate all your debts, make a plan to pay off the littlest one. This is known as the snowball method, and it has been proven time and again to be the fastest way to pay off debt. Get on a budget, get on the same page as your spouse, and find ways to increase your income. Learn the exact methods I used here.